Initial appointment Fee

A fee of $300 plus GST.

Services we offer

Cash flow management

Cash flow and enabling some of your income to be effectively saved and invested is so important in building wealth. We assist you in this process and in keeping accountable.

Investment management and planning

We help you cut through the complexity and make sound investment and planning decisions in a collaborative manner.

Superannuation and retirement advice

We assist you in having enough for your retirement and in using superannuation as a vehicle for long term investment.

Tailored financial planning for lawyers

One of our niche specialities is helping lawyers with their planning needs and we have various service packages for those in the profession.

Asset protection and risk management

The foundation of planning and investment is protecting risk where you can. We help you do so in a manner that is appropriate to you.

Estate planning

An oft forgotten area, we facilitate you getting your house in order and in planning to have the right assets provided to the right people at the right time.

Why Choose Us?

We take the time to understand you

We get our energy from helping you towards your ongoing success

We are passionate about serving you

Because we think you will be pleasantly surprised!

How we can help you

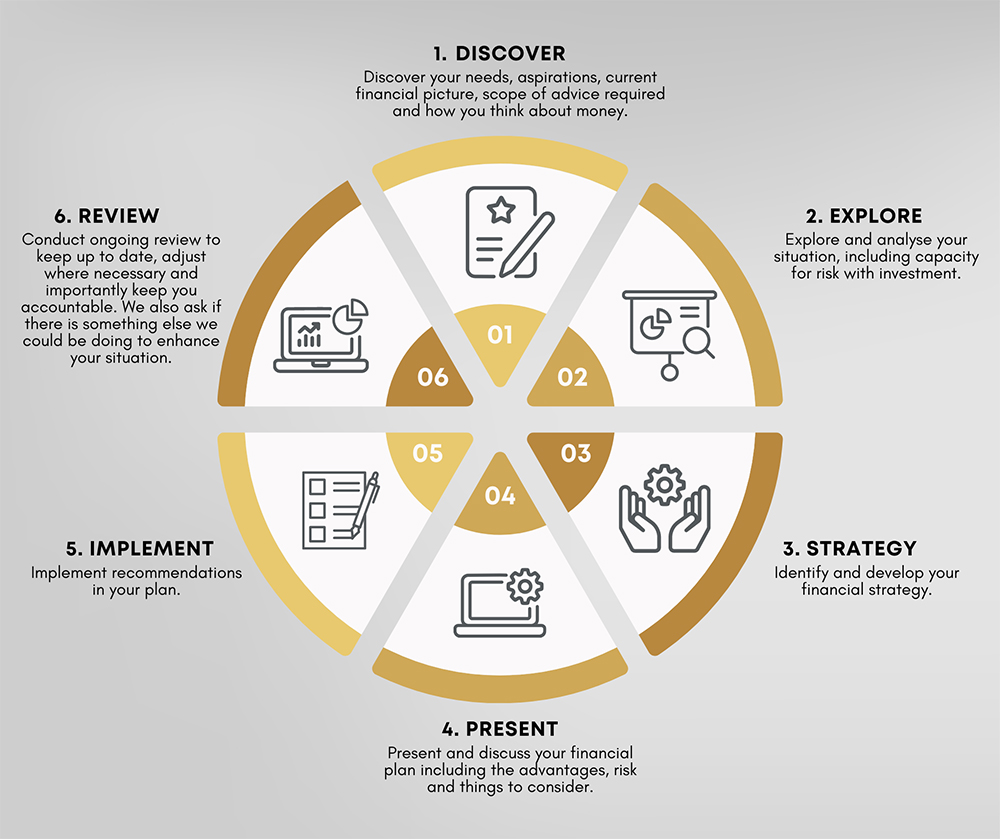

The process

Our advice process is tailored to helping us understand you and provide advice that is tailored to your situation and objectives. We work with you to understand where you are now, where you would like to get to financially and how we can assist you in more efficiently getting there. The advice process moves through distinct phases of client discovery and requirements, strategy development, advice presentation and discussion and advice implementation. For most, ongoing review will then follow, being an important part of the puzzle.

Outcomes from this are being better informed and more financially confident.

General advice disclaimer:

Any advice or information in these videos is of a general nature only and has not taken into account your personal objectives, financial situation and needs. Because of that, before acting on the advice, you should consider its appropriateness to you, having regard to your personal objectives, financial situation and needs.

Before making a decision to acquire a financial product, you should obtain and read the Product Disclosure Statement (PDS) relating to that product, and to seek appropriate advice.

Opinions constitute our judgement at the time of issue and are subject to change. Neither the Licensee, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document.

The information in this communication reflects our understanding of existing legislation, proposed legislation, rulings as at the date of issue. In some cases, the information has been provided to us by third parties. While it is believed the information is accurate and reliable, this is not guaranteed in any way.

Incito Wealth Pty Ltd is a Corporate Authorised Representative (446880) of Alliance Wealth Pty Ltd ABN 93 161 647 007 AFSL No. 449221. Part of the Centrepoint Alliance group. Link to FSG